War In Ukraine Puts Spotlight on Crypto

Crypto is being used by both sides, just like any other technology.

Bitcoin was founded, at least in part, to create a currency that could exist above the laws of any country, beyond the reach of regulators, and mainly outside the existing financial system. It has since been co-opted by an industry of speculators looking to cash in, but it's core libertarian base is still there.

Now Russia’s invasion of Ukraine has put a new priority on applying international law and government oversight; it is no surprise that cryptocurrencies are struggling to adapt to the new landscape.

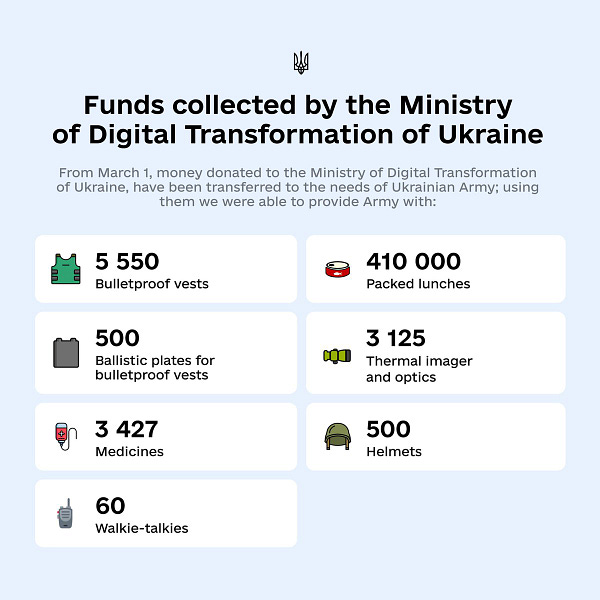

Ukraine has collected more than $120M in cryptocurrencies since the invasion began. This money is being deployed directly in the country without passing through international gatekeepers. Alex Bornyakov, the deputy minister of Digital Transformation of Ukraine, tweeted:

There are dozens of cool, and possibly helpful fundraising operations out there. This one actually made me want to buy an NFT.

At the same time, crypto is almost certainly being used to avoid sanctions. The blockchain research firm Elliptic has already found more than $5M of Russian wallet addresses created to bypass international sanctions on more than 400 different platforms.

This tension has not been lost on Washington. Fed Chair Pro Tempore Jerome Powell testified before congress and pointed directly at the Ukraine conflict as the reason for more crypto regulation.

“[The Ukraine-Russia conflict] underscored the need for Congressional action on digital finance, including cryptocurrencies,” Powell said. “We have this burgeoning industry which has many parts to it, and there isn’t in place the kind of regulatory framework that needs to be there.”

That is why Senator Elizabeth Warren has joined other senators in calling for a new regulation that would force crypto changes to behave more like banks. Specifically, she wants to force them to verify their customers.

Anonymity, of course, is part of the core of crypto ideology. Once identified, its regulators will be able to crack down on Russian oligarchs, but also all sorts of other nefarious crypto activities--ransomware, child pornography, terrorism. Oh, also, tax evasion. It is no exaggeration today that this law would kill crypto as we know it.

Crypto is being used by both sides in this fight and that makes sense. New technologies are not good or bad, but they aren’t neutral either.

Whatever your side, it is clear crypto has legitimacy it lacked just a few months ago. And it is getting attention from all sides.

Today’s Bits

Should You Buy Kaspersky Security Products?

PCMag’s Neil Rubenking says you shouldn't. This is a huge shift in policy for the publication.

Nemesysco spinoff unveils emotional detection and AI tools for metaverse

Automation could send long-haul truckers driving into the sunset

Last Chance to Join Me at the Techonomy Climate Summit

Join me at Techonomy Climate on March 29 in Mountain View, CA. The conference brings together climate startup leaders, big company sustainability chiefs, climate tech investors, environmental justice activists, and longtime climate experts for conversations on the most pressing challenges and opportunities.

I will be talking to Evîn Cheikosman, Policy Analyst, Crypto Impact and Sustainability Accelerator, World Economic Forum, about the sustainability of Crypto.

The conference includes over 30 speakers and you can view the full list here.

Registration includes breakfast, lunch, access to all sessions, and a closing cocktail reception. As a Machined member, your ticket to Techonomy Climate is reduced to $199 (Standard price: $299).

Register here: https://techonomy.com/registration/register-for-techonomy-climate/